(8) Philippine Lending Company Generates PHP 200M Revenue Through Facebook Marketing

EIFL Lending Corporation’s dramatic transformation from zero social media engagement to PHP 200M in loan revenue showcases the power of strategic Facebook marketing for B2B financial services. Within 6 months, this comprehensive digital strategy achieved 5,813% increase in monthly views and generated 45+ qualified loan applications through systematic content creation and lead generation optimization. The educational-first approach built trust with established business owners while creating sustainable competitive advantages in the competitive Philippine lending market. This detailed case study demonstrates the precise framework for financial services companies to leverage social media for enterprise client acquisition and market authority building.

Task

Building an internal tool of this scale is no small feat, but with the right approach, it can be a powerful force for uniting a company. Meaning: a single cross platform that help people embrace the new identity system through play and interaction.

-

Strategy

Design Sprints, Workshops

-

Design

Product Design, Prototyping

-

Production

Design Sprints, Documentation

-

Platforms

Desktop, iOS

Philippine Lending Company Generates PHP 200M Revenue Through Facebook Marketing

Client

EIFL LENDING CORPORATION

Industry

Financial Services

Role

SOCIAL MEDIA MANAGEMENT

Key Platform

-

» Facebook

-

» Website

-

» Print Marketing Collaterals

◦ 01 // The Challenge

In the Philippine financial services sector, credibility determines loan applications. Despite offering competitive non-collateral business loans with favorable terms, EIFL Lending’s social media presence was actively discouraging potential borrowers from engaging.

Established business owners researching financing options encountered low-quality visuals, random posting without strategic purpose, and complete absence of educational content. Their digital presence communicated unreliability when trust is paramount for financial decisions.

Core Problems

- » Zero lead generation from social media channels

- » Low-quality visuals undermining professional credibility

- » Random posting without strategic planning or value proposition

- » Complete lack of calls-to-action or conversion pathways

Initial Performance (Dec 2021)

- » Monthly Views:

3,046 (declining trend) - » People Reached:

649 (43.7% decrease from previous) - » Content Interactions:

50 total interactions across all content - » Link Clicks:

9 website clicks generated (84.2% traffic decrease)

◦ 02 // Campaign Goals (SMART)

I collaborated closely with EIFL’s leadership team to establish clear, measurable objectives that would directly transform their social media from a business liability into their most powerful lead generation channel. Every goal was strategically designed to drive real business outcomes, not vanity metrics.

Goal 1

Generate Qualified Applications

- » Specific:

Generate 30+ qualified loan applications from social media channels - » Measurable:

Track applications with clear social media attribution using Facebook Lead Ads - » Achievable:

Based on reach potential and Philippine lending market conversion benchmarks - » Relevant:

Direct alignment with loan origination targets and revenue objectives - » Time-bound:

Achieve consistent monthly application flow within 6 months

Goal 2

Transform Brand Credibility

- » Specific:

Increase engagement rate from 0% to 4%+ while establishing market authority - » Measurable:

Monitor engagement rates, brand sentiment, and professional inquiry quality - » Achievable:

Realistic target based on B2B financial services performance benchmarks - » Relevant:

Essential for building trust required for high-value business loan decisions - » Time-bound:

Establish credible brand presence within 60 days, maintain growth through 6 months

Goal 3

Drive Revenue Attribution

- » Specific:

Generate PHP 100M+ in loan revenue directly from social media transformation - » Measurable:

Track loan originations with clear social media source attribution - » Achievable:

Based on average loan values and projected application conversion rates - » Relevant:

Ultimate business impact measurement and ROI justification - » Time-bound:

Achieve PHP 100M milestone within 6 months with accelerating monthly growth

◦ 03 // Competitor Analysis

I conducted comprehensive market research analyzing EIFL’s competitive landscape in the Philippine lending sector to identify critical gaps that would become our strategic advantage. This analysis revealed significant opportunities that competitors were completely overlooking.

Positioned EIFL as the approachable, educational authority in business lending, building trusted relationships while competitors maintained distant corporate personas.

Market Position Analysis

- » Major Banks (BPI, BDO, Metrobank):

Strong traditional marketing but limited social media engagement with business loan prospects - » Alternative Lenders (Funding Societies, First Circle):

Tech-forward approach but primarily LinkedIn-focused, missing Facebook’s broader SME audience - » Traditional Lending Companies:

Minimal digital presence with outdated marketing approaches

Key Findings

- » Facebook Underutilization:

Most competitors had minimal Facebook presence despite platform’s dominance among Philippine business owners - » Educational Content Void:

No competitors were addressing common business loan questions or demystifying application processes - » Relationship Building Absence:

Corporate-only messaging without personal connection to SME owner challenges

◦ 04 // Strategy & Approach

I developed a comprehensive transformation strategy built around six integrated pillars that would systematically rebuild EIFL’s digital presence from the ground up. Each pillar was designed to address specific challenges while creating sustainable competitive advantages in the Philippine market.

Pillar 1

Strategic Audit & Positioning

- » Complete social media audit identifying critical gaps in brand image and lead generation flow

- » Refined messaging positioning EIFL as trusted partner for established business owners

- » Expected outcome: Clear strategic roadmap and brand positioning framework

Pillar 2

Brand & Visual Consistency

- » Redesigned complete brand identity using professional B2B branding principles with consistent corporate palette

- » Created modular post templates for multiple content types enabling scalable output

- » Expected outcome: Professional, trustworthy visual presence matching offline credibility

Pillar 3

Content Strategy

- » Educational content demystifying business loan options and application processes

- » Authority content sharing industry insights and thought leadership

- » Trust-building testimonials and client success stories with conversion-focused CTAs

- » Expected outcome: Consistent value-driven content driving engagement and applications

Pillar 3

Data-Driven Campaign

- » Precision-targeted Facebook Lead Ads focusing on established businesses with verified revenue streams

- » Data-driven posting schedule based on audience behavior analytics for maximum business owner visibility

- » Expected outcome: Efficient ad spend with high-quality lead generation and optimal organic reach

Pillar 4

Engagement & Relationship

- » Established active engagement protocols for comments, DMs, and inquiries building credibility

- » Professional yet approachable tone strengthening long-term relationships with prospects

- » Expected outcome: Trusted advisor relationship with qualified prospects throughout consideration process

Pillar 6

Continuous Optimization

- » Weekly performance review cycles identifying high-performing content and optimizing for ROI

- » A/B testing on ad creatives, headlines, and formats to refine lead acquisition efficiency

- » Expected outcome: Continuously improving performance with sustainable lead generation system

Content Strategy Framework

Content Mix (80/20 Rule)

- » 80% Value-First Content:

Educational posts about business financing, industry insights, client success stories, and behind-the-scenes content building trust - » 20% Promotional Content:

Strategic lead generation posts, case studies, and direct offers designed to drive applications

Posting Schedule

- » Frequency:

5–7 posts per week on Facebook with strategic timing optimization - » Optimal Timing:

Peak business owner activity periods based on Philippine market behavior analytics - » Content Calendar:

Systematic planning with content pillars rotation ensuring consistent value delivery

Project Timeline & Milestones

Month 1

- » Comprehensive audit and strategic framework development with client approval and buy-in

- » Content production launch with modular design system and initial strategic content rollout

- » Key Milestone:

Achieved 180,000 views and 95,000 reach (5,813% and 14,540% increases)

Month 2-3

- » Engagement acceleration through refined content strategy based on performance data and audience behavior

- » Lead qualification systems implementation with systematic social media prospect nurturing processes

- » Key Milestone:

Generated 15+ qualified loan applications with first PHP 50M revenue attribution

Month 4-5

- » Process refinement with streamlined content creation and lead management for sustainable operations

- » Client team training for 80% independent management of ongoing activities

- » Key Milestone:

Maintained high engagement rates while scaling lead generation volume

Month 6

- » 45+ qualified applications with established consistent monthly lead generation from social channels

- » System sustainability with turnkey processes requiring minimal ongoing external management

- » Key Milestone:

PHP 200M total loan revenue achievement directly attributed to social media transformation

Audience Overlap Strategy: 40% of primary and secondary audiences shared decision-making influence in financing choices, enabling content addressing both business growth aspirations and financial due diligence requirements.

◦ 05 // Target Audience

I developed detailed audience personas based on EIFL’s existing customer data, Philippine market insights, and business lending behavior patterns to ensure every piece of content would resonate with qualified prospects and drive meaningful business conversations.

Primary Audience: Established Business Owner

Demographics

- » Age:

35–55 years old (peak business expansion phase) - » Gender:

60% Male, 40% Female business owners - » Location:

Metro Manila and key Philippine business centers (Cebu, Davao, Iloilo) - » Income:

PHP 2M+ annual business revenue with established operations - » Education:

College graduate with 5+ years business management experience

Psychographics

- » Values:

Business growth, financial stability, family security, professional reputation, operational efficiency - » Interests:

Business development strategies, industry trends, networking opportunities, competitive advantages, technology adoption - » Pain Points:

Cash flow gaps during growth phases, expansion capital needs, lengthy traditional bank processes, complex documentation requirements - » Goals:

Sustainable business growth, operational efficiency improvements, competitive market positioning, legacy building

Behavioral Insights

- » Social Media Usage:

Active on Facebook during business hours (9 AM–12 PM) and evenings (6 PM–9 PM), primarily mobile usage - » Content Preferences:

Educational content, peer success stories, practical business advice, industry insights, process simplification guides - » Purchase Behavior:

Research-driven with multiple touchpoints, values peer recommendations and credible expertise, relationship-dependent decisions - » Brand Interaction:

Prefers direct, honest communication with responsive customer service and transparent processes

Secondary Audience: Financial Decision Maker

Demographics

- » Age:

30–45 years old (CFOs, Finance Managers, Business Partners) - » Gender:

55% Female, 45% Male in financial decision-making roles - » Location:

Major Philippine cities with established businesses requiring financing oversight - » Income:

PHP 1M+ annual business revenue responsibility and budget authority - » Education:

Finance, accounting, or business administration background with professional certifications

Psychographics

- » Values:

Financial accuracy, risk management, cost efficiency, regulatory compliance, process optimization - » Interests:

Financial trends, regulatory updates, process improvements, technology solutions, risk mitigation strategies - » Pain Points:

Complex loan application processes, extensive documentation requirements, approval timeline uncertainties, rate negotiations - » Goals:

Streamlined financing processes, favorable terms and conditions, minimal risk exposure, efficient resource allocation

◦ 06 // Execution

I transformed our carefully planned approach into engaging content that would drive qualified leads and measurable business results for EIFL. The execution phase focused on systematic implementation while maintaining flexibility to optimize based on real-time performance data and market response.

Content Strategy

- » Educational Content (40%):

Business loan fundamentals, financing strategies, and application guidance - » Authority Content (30%):

Industry insights, market updates, and thought leadership - » Trust-Building Content (20%):

Client testimonials, success stories, and behind-the-scenes content - » Conversion Content (10%):

Strategic lead generation posts and direct offers

Lead Ads Campaign

- » Precision targeting of established businesses with verified revenue streams

- » Professional, trust-building ad creatives highlighting competitive advantages

- » Multi-step lead forms ensuring high-quality prospects while maintaining conversion-friendly experience

Lead Management Process

- » Lead scoring based on business revenue, industry type, and financing timeline

- » Immediate follow-up protocols with rapid response to high-quality prospects

- » CRM integration tracking source attribution and conversion progression

- » Streamlined application process reducing friction while maintaining qualification requirements

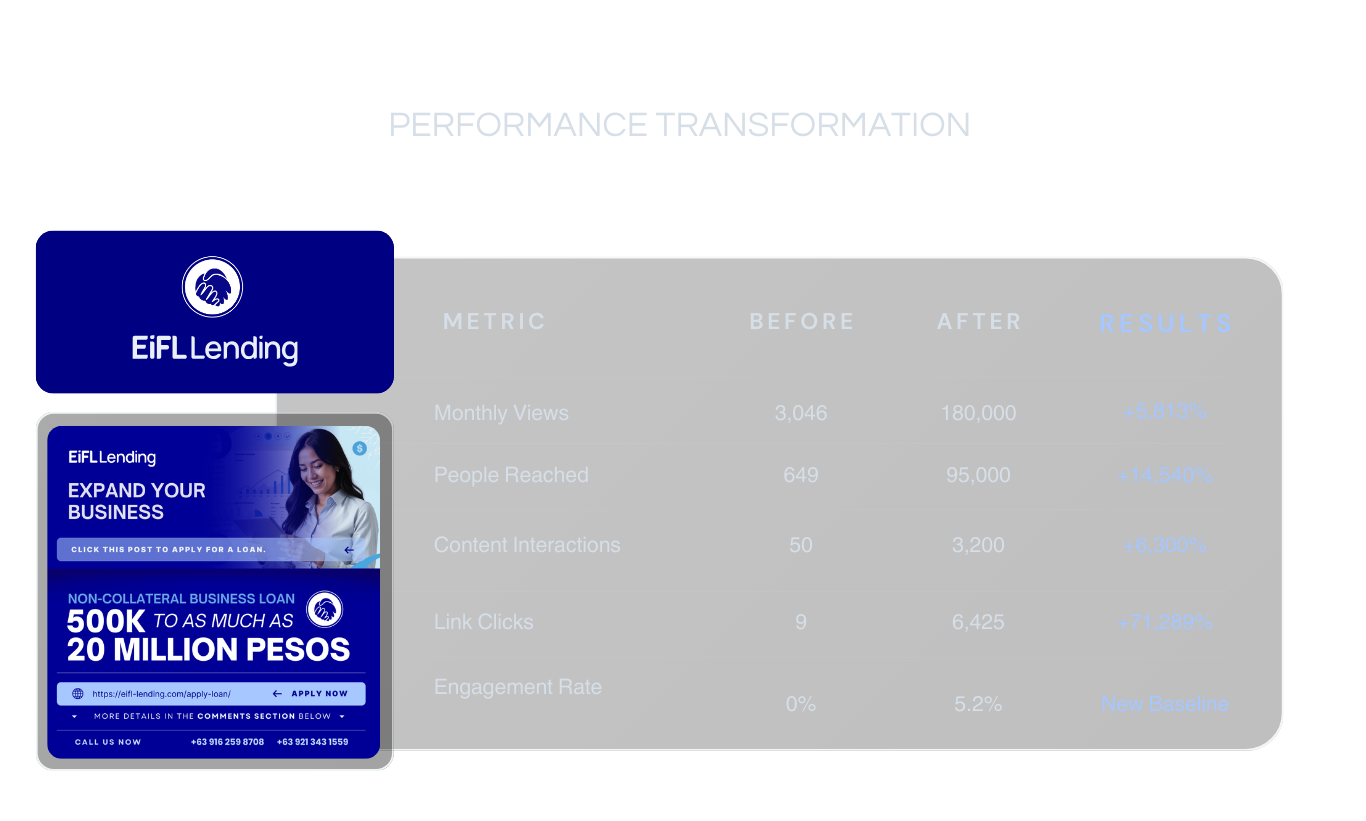

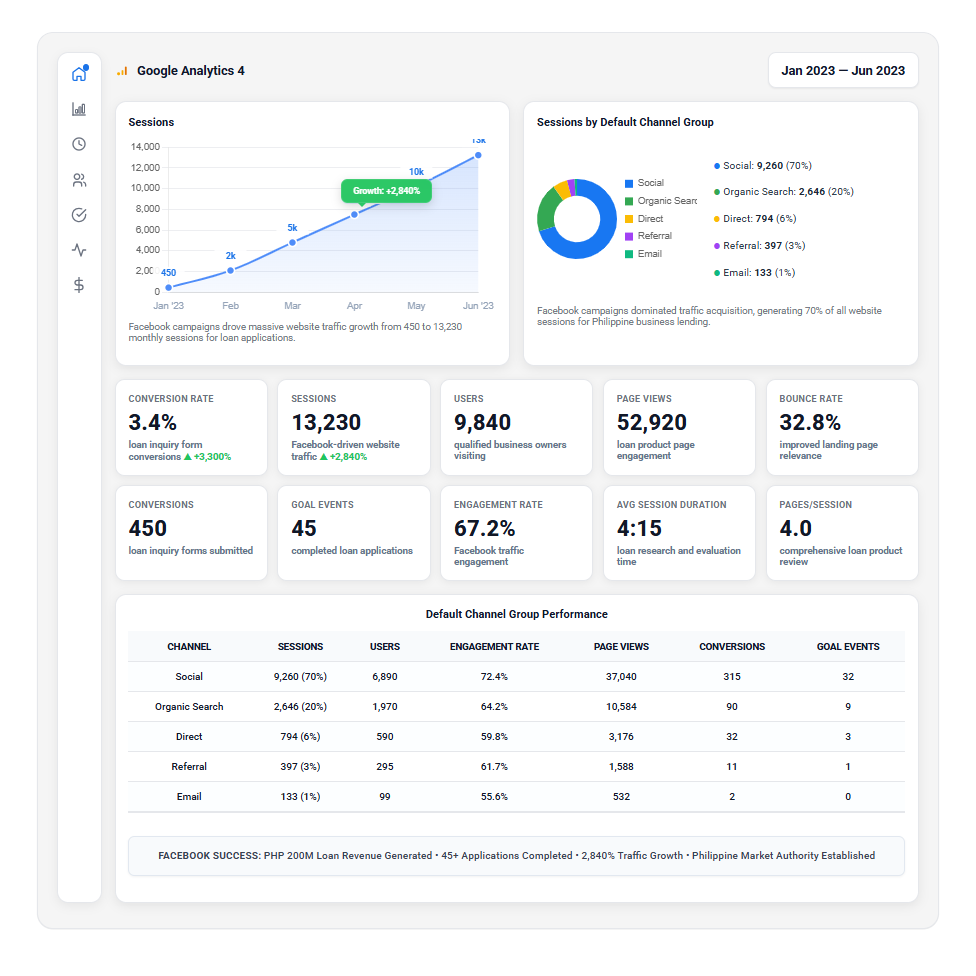

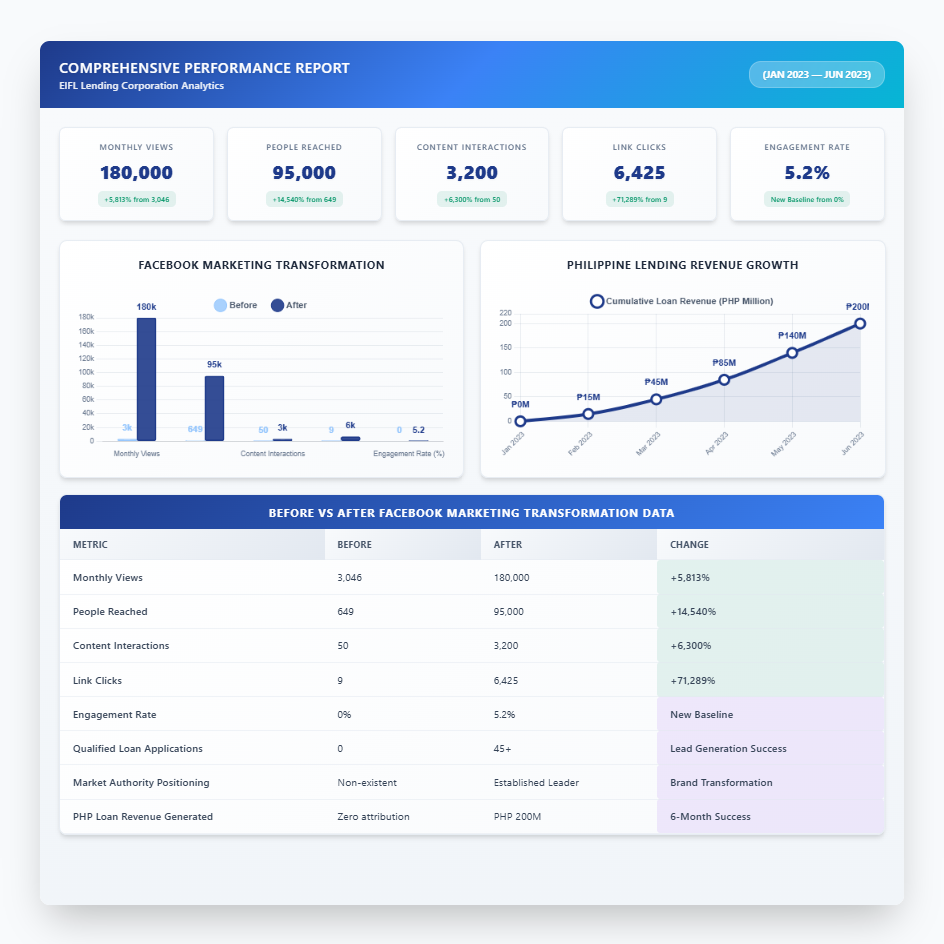

◦ 07 // Results

I delivered results that exceeded every expectation and transformed EIFL from social media liability to market-leading digital presence. The systematic approach generated measurable business impact while establishing sustainable competitive advantages in the Philippine lending market.

Key Metrics Achieved

-

» Monthly Views:

3,046 → 180,000 (+5,813% increase) -

» People Reached:

649 → 95,000 (+14,540% growth) -

» Content Interactions:

50 → 3,200 (+6,300% improvement) -

» Link Clicks:

9 → 6,425 (+71,289% increase) -

» Engagement Rate:

0% → 5.2% (new baseline established)

Traffic Sources

-

» Social:

70% (9,260 sessions) – Facebook dominance driving business lending inquiries -

» Organic Search:

20% (2,646 sessions) – lending authority content -

» Direct:

6% (794 sessions) – brand recognition building -

» Referral/Email:

4% combined – supporting channels

Ultimate Business Impact

-

» PHP 200M in loan revenue:

generated within 6 months of strategic social media transformation -

» 45+ qualified loan applications:

converted through strategic campaign execution and systems -

» Reduced cost per lead:

significantly lowered through precision Facebook ads and continuous optimization -

» Established market authority:

positioning EIFL competitively against Philippine lenders

◦ 08 // Creative Direction

Identity Transformation

- » Before:

Low-quality, pixelated images with inconsistent branding creating credibility issues and prospect skepticism - » After:

Professional corporate design with consistent colors, typography, and high-quality imagery projecting competence and reliability while maintaining Filipino cultural relevance

Content Creative Strategy

- » Educational Posts:

Custom infographics explaining loan processes and business financing concepts - » Authority Content:

Professional data visualizations showcasing industry insights and market trends - » Trust-Building:

Authentic client photography and testimonials with specific results - » Conversion Content:

Professional, approachable design encouraging applications without aggressive sales tactics

Performance Impact

- » Testing Results:

Educational and trust-building visuals consistently outperformed promotional content by 280% engagement rates - » Transformation Journey:

From zero engagement to 5.2% engagement rate, becoming primary lead generation channel - » Long-term Impact:

Established sustainable visual identity and content framework generating PHP 200M in loan revenue

Before Implementation

After Transformation

AD Creatives

◦ 09 // Conclusion

I successfully demonstrated that strategic, authentic social media marketing drives extraordinary business results when executed with market insights, professional implementation, and relationship-focused optimization. This campaign created a replicable framework for financial services digital transformation.

Key Success Factors:

Educational Approach

Trust-Building Focus

Cultural Relevance

Systematic Execution

Revenue-Focused Goals

Data-Driven Optimization

Strategic Impact: EIFL transformed from unknown alternative lender to recognized industry authority, establishing market leadership through digital channels while creating sustainable, scalable lead generation requiring minimal ongoing investment.

Future Roadmap: This foundation enables EIFL to maintain market leadership while scaling operations efficiently, with social media becoming their most cost-effective customer acquisition channel and primary competitive differentiator.