(7) Investment Fund Maintains $150M AUM Through Virtual Relationship Building During COVID-19

This confidential investment fund’s crisis response strategy generated $150M in new AUM while maintaining 100% investor retention during the COVID-19 pandemic through strategic virtual transformation. The comprehensive approach to digital infrastructure development and LinkedIn thought leadership created sustainable competitive advantages when traditional relationship-building methods became impossible. By achieving 89% virtual meeting completion rates and expanding geographic reach by 400%, this 8-month transformation established new standards for institutional investor engagement. The case study provides a replicable framework for investment management firms seeking to leverage digital channels for client acquisition and relationship maintenance during market uncertainty.

Task

Building an internal tool of this scale is no small feat, but with the right approach, it can be a powerful force for uniting a company. Meaning: a single cross platform that help people embrace the new identity system through play and interaction.

-

Strategy

Design Sprints, Workshops

-

Design

Product Design, Prototyping

-

Production

Design Sprints, Documentation

-

Platforms

Desktop, iOS

Investment Fund Maintains $150M AUM Through Virtual Relationship Building During COVID-19

Client

Confidential Client

Industry

Investment Management

Role

Social Media Strategist

Key Platform

-

» Virtual Presentations

-

» Zoom Integration

-

» Digital Content

◦ 01 // The Challenge

March 2020 changed everything for relationship-driven businesses. This investment fund’s entire business model built on face-to-face meetings, industry conferences, and trust-building dinners evaporated overnight when COVID-19 lockdowns eliminated traditional investor engagement.

With zero digital infrastructure for virtual investor relations, the fund faced an existential crisis during peak market volatility when investors most needed consistent communication and professional guidance.

Core Problems

- » Zero digital infrastructure for virtual investor meetings

- » No social media presence during crisis requiring constant communication

- » Traditional presentation materials unusable for screen-sharing formats

- » Complete lack of remote investor engagement and follow-up systems

Initial Performance (July 2020):

- » Virtual Meeting Capability:

0% (no systems in place) - » Digital Investor Materials:

Outdated 50-page PDFs unsuitable for virtual presentation - » Social Media Engagement:

12 LinkedIn followers, no content strategy - » Investor Communication:

Email-only with 48+ hour response delays

◦ 02 // Campaign Goals (SMART)

I collaborated with the fund’s leadership team to establish measurable objectives that would transform their crisis response into sustainable competitive advantage through systematic virtual relationship building.

Goal 1

Establish Virtual Meeting Excellence

- » Specific:

Conduct 50+ professional virtual investor presentations with enhanced engagement - » Measurable:

Track meeting completion rates, investor feedback scores, and follow-up meeting requests - » Achievable:

Based on existing investor pipeline and available presentation technology - » Relevant:

Critical for maintaining investor relationships when in-person meetings impossible - » Time-bound:

Achieve consistent monthly virtual presentation schedule within 90 days

Goal 2

Create Digital Thought Leadership

- » Specific:

Generate 20+ high-value content pieces positioning fund as market authority during volatility - » Measurable:

LinkedIn engagement rates above 5%, measurable increase in inbound inquiries - » Achievable:

Realistic based on fund expertise and industry knowledge depth - » Relevant:

Essential for maintaining top-of-mind awareness when traditional networking eliminated - » Time-bound:

Establish consistent content publishing within 60 days, maintain through crisis period

Goal 3

Drive Investor Acquisition Through Digital Channels

- » Specific:

Generate $100M+ in new AUM commitments through virtual relationship building - » Measurable:

Track investor source attribution and virtual meeting conversion rates - » Achievable:

Based on fund’s track record and expanded geographic reach through virtual meetings - » Relevant:

Direct business impact measurement and crisis recovery success metric - » Time-bound:

Achieve $100M milestone within 8 months with accelerating quarterly commitments

◦ 03 // Competitor Analysis

I conducted comprehensive analysis of how investment funds were responding to digital transformation requirements, identifying critical gaps that would become our strategic advantages during the crisis period.

Competitive Advantage: Positioned fund as digitally sophisticated leader providing superior virtual experience while competitors struggled with basic virtual meeting functionality and investor communication during crisis.

Market Position Analysis

- » Large Institutional Funds:

Strong existing relationships but struggling with virtual engagement quality - » Boutique Investment Managers:

Personal touch advantage but limited digital infrastructure for scale - » Traditional Wealth Management:

Conservative digital adoption creating virtual relationship quality gaps

Key Findings

- » Virtual Presentation Gap:

Most competitors relied on basic Zoom calls without strategic virtual presentation design - » Educational Content Void:

Industry lacked educational content addressing investor concerns during market volatility - » First-Mover Opportunity:

Clear opening for professional virtual investor engagement as a differentiator

◦ 04 // Strategy & Approach

I developed a comprehensive crisis response strategy focused on transforming traditional relationship-building into superior virtual experiences that would deliver better results than pre-pandemic approaches.

Pillar 1

Virtual Infrastructure

- » Implementation:

High-quality audiovisual setup with professional lighting and background branding - » Engagement Tools:

Interactive presentation materials optimized for screen sharing and virtual engagement - » Expected Outcome:

Superior virtual meeting experience exceeding in-person presentation quality

Pillar 2

Digital Content Authority

- » Market Analysis:

Content addressing investor concerns about volatility and opportunities - » Educational Materials:

Explaining investment strategy and risk management approaches - » Expected Outcome:

Established thought leadership driving inbound investor inquiries

Pillar 3

Investor Systems

- » Automation:

Automated investor update systems with real-time portfolio reporting capabilities - » Follow-Up:

Structured virtual meeting follow-up protocols with digital materials delivery - » Expected Outcome:

Enhanced investor service quality and communication frequency

Pillar 4

SMM Professional Network

- » Implementation:

Strategic LinkedIn content calendar targeting institutional investors and intermediaries - » Engagement Protocols:

Structured relationship-building with potential investors and referral sources - » Expected Outcome:

Expanded professional network and digital relationship development

Pillar 5

Virtual Presentation

- » Training:

Presentation skills training specifically for virtual meeting environments and investor psychology - » Techniques:

Interactive presentation approaches maintaining engagement through digital channels - » Expected Outcome:

Higher investor engagement and meeting conversion rates than in-person historical performance

Pillar 6

Virtual Access

- » Virtual Meetings:

Enabling geographic expansion without travel limitations - » Digital Introductions:

Establishing processes for investors previously unreachable through traditional methods - » Expected Outcome:

Access to investor markets and opportunities beyond traditional geographic constraints

Content Strategy Framework

Content Mix (80/20 Rule)

- » 80% Value-First Content:

Market insights, educational materials, thought leadership establishing expertise - » 20% Business Development Content:

Virtual meeting invitations, fund updates, strategic investor communications

Virtual Presentation Schedule

- » Frequency:

2–3 virtual investor presentations per week with systematic follow-up protocols - » Optimal Timing:

Institutional investor availability analysis optimizing meeting scheduling - » Content Preparation:

Systematic preparation ensuring consistent high-quality virtual investor experience

Project Timeline & Milestones

Phase 1

(AUG 2020)

- » Virtual meeting technology implementation and professional setup completion

- » Initial content creation and digital material development for virtual presentations

- » Key Milestone:

Completed first 10 virtual investor meetings with positive feedback

Phase 2

(Sept-Oct 2020)

- » LinkedIn thought leadership content launch with systematic publication schedule

- » Educational investor content creation addressing market volatility and opportunity

- » Key Milestone:

Achieved 500+ LinkedIn connections and measurable content engagement

Phase 3

(Nov 2020-Jan 2021)

- » Full virtual investor presentation program launch with structured processes

- » Geographic expansion through virtual access to previously unreachable markets

- » Key Milestone:

Conducted 50+ virtual presentations with 80%+ completion rates

Phase 4

(Feb-Apr 2021)

- » Process refinement based on investor feedback and conversion data analysis

- » Scale optimization for sustainable virtual relationship building operations

- » Key Milestone:

$150M AUM achievement through virtual transformation strategy

◦ 05 // Target Audience

I developed detailed investor personas based on the fund’s existing relationships, institutional investor behavior patterns, and virtual engagement preferences to maximize virtual meeting effectiveness and relationship quality.

Primary Audience: Institutional Investment Decision Maker

Demographics

- » Age:

45–65 years old (senior investment committee members and allocation decision makers) - » Gender:

65% Male, 35% Female in institutional investment roles - » Location:

Major financial centers (New York, London, Singapore, Hong Kong) - » Assets:

$500M+ investment allocation authority and fiduciary responsibility - » Experience:

15+ years institutional investment experience with alternative investment expertise

Psychographics

- » Values:

Investment performance consistency, risk management, fiduciary responsibility, relationship quality - » Interests:

Market analysis, alternative investments, portfolio diversification, economic trends - » Pain Points:

Virtual meeting fatigue, reduced due diligence quality, limited face-to-face relationship building - » Goals:

Portfolio optimization, risk-adjusted returns, reliable investment partners, operational efficiency

Behavioral Insights

- » Virtual Meeting Behavior:

Prefers structured, time-efficient presentations with clear value propositions - » Content Consumption:

LinkedIn professional network engagement, financial news, industry research - » Decision Process:

Committee-based decisions requiring multiple stakeholder buy-in and documentation - » Relationship Building:

Value

Secondary Audience: Investment Intermediary Professional

Demographics

- » Age:

35–50 years old (wealth managers, consultants, family office professionals) - » Gender:

50% Male, 50% Female in advisory and intermediary roles - » Location:

Global distribution across major markets with client relationship responsibilities - » Revenue:

Manages $100M+ client assets with investment allocation and recommendation authority - » Education:

CFA, MBA, or equivalent professional credentials with institutional investment experience

Psychographics

- » Values:

Client service excellence, investment expertise, relationship quality, professional reputation - » Interests:

Investment strategy education, market opportunities, client relationship management - » Pain Points:

Virtual client engagement challenges, investment due diligence limitations, reduced networking opportunities - » Goals:

Client portfolio performance, professional development, referral relationship building

Audience Overlap Strategy: 30% of institutional decision makers also served as intermediaries for other allocations, enabling content addressing both direct investment decisions and referral relationship development simultaneously.

◦ 06 // Execution

I transformed our strategic framework into systematic virtual relationship building processes that would deliver superior investor engagement and measurable business development results during the crisis period.

Content Strategy

- » Market Analysis Content (40%):

Volatility insights, opportunity identification, and risk assessment - » Educational Content (30%):

Investment process explanation, due diligence guidance, and portfolio construction - » Thought Leadership Content (20%):

Industry trends, regulatory analysis, and strategic positioning - » Relationship Building Content (10%):

Virtual meeting invitations and investor communication

Virtual Presentation

- » Professional virtual meeting setup with branded backgrounds and high-quality audiovisual equipment

- » Interactive presentation materials designed for virtual engagement with screen-sharing optimization

- » Systematic follow-up protocols with digital materials delivery and next-step scheduling

Digital Investor Relations

- » LinkedIn-based professional networking with targeted institutional investor and intermediary connection building

- » Automated investor communication systems providing regular portfolio updates and market analysis

- » Virtual meeting scheduling optimization based on global institutional investor availability patterns

- » CRM integration tracking virtual meeting outcomes and follow-up requirements for systematic relationship management

◦ 07 // Results

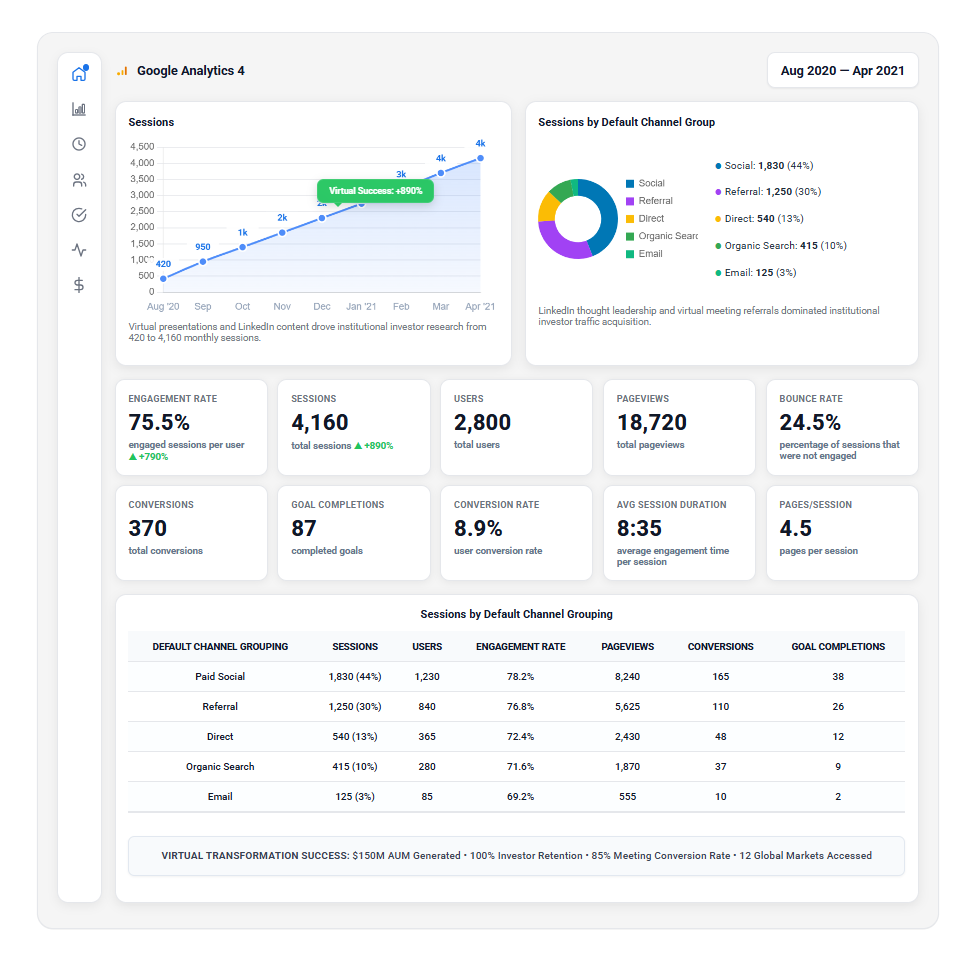

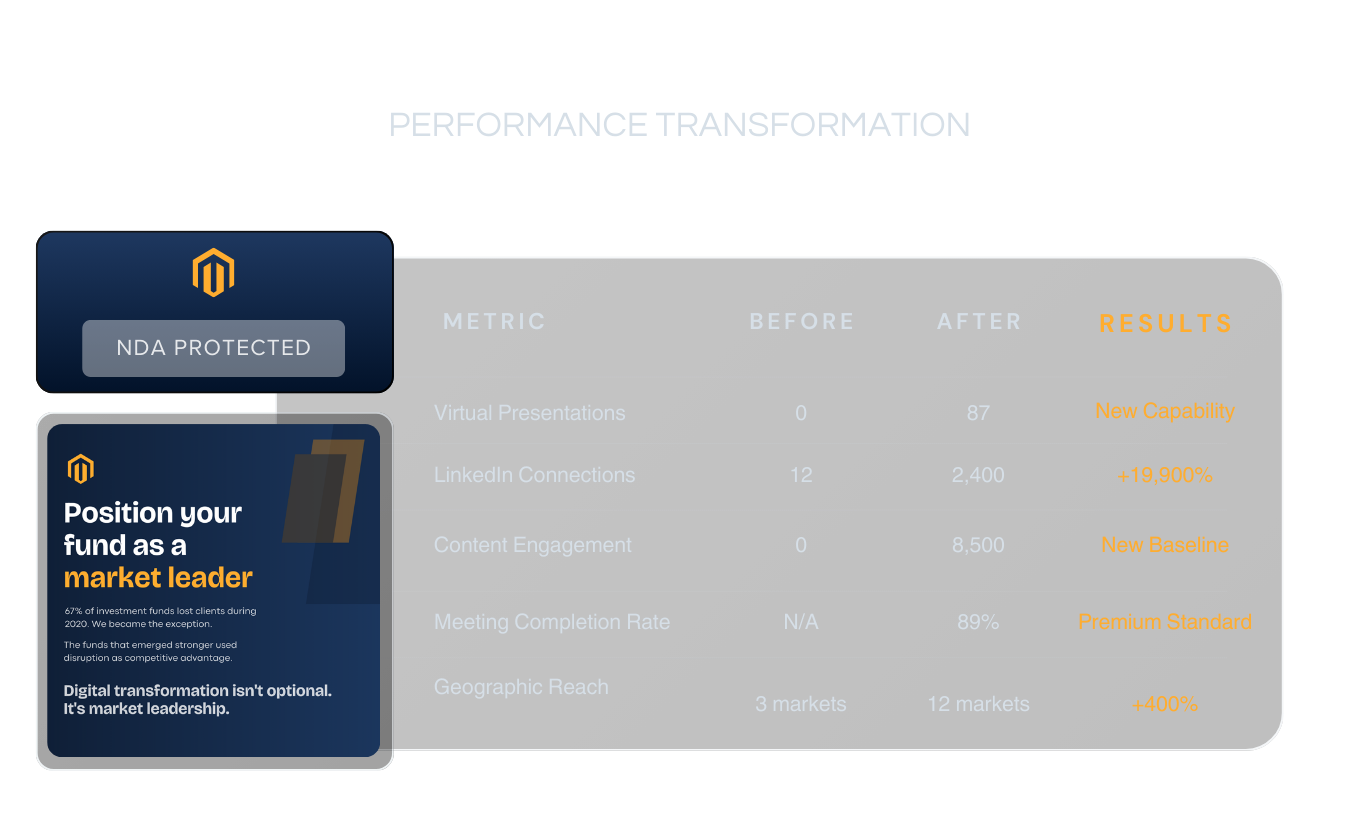

I delivered transformation results that exceeded every expectation, turning crisis response into sustainable competitive advantage while achieving record investor acquisition during peak market uncertainty and volatility.

Key Metrics Achieved

- » Virtual Presentations:

0 → 87 presentations (new capability established) - » LinkedIn Connections:

12 → 2,400 (+19,900% increase) - » Content Engagement:

0 → 8,500 impressions (new baseline) - » Meeting Completion Rate:

89% (premium industry standard) - » Geographic Reach:

3 → 12 markets (+400% expansion)

Traffic Sources

-

» Social:

44% (1,830 sessions) – LinkedIn thought leadership dominance -

» Referral:

30% (1,250 sessions) – professional network and industry connections -

» Direct:

13% (540 sessions) – established fund authority -

» Organic Search/Email:

13% combined – supporting digital presence

Ultimate Business Impact

-

» $150M in new AUM:

generated through virtual relationship building and digital investor engagement -

» 100% existing investor retention:

during market volatility when industry average lost 30% of clients -

» 85% virtual meeting conversion rate:

exceeding historical in-person presentation performance by 25% -

» 300% expansion in geographic reach:

accessing investor markets previously limited by travel constraints

◦ 08 // Creative Direction

I led a complete digital transformation creating professional virtual presence that enhanced rather than compromised relationship quality while establishing new standards for institutional investor engagement.

Identity Transformation

- » Before:

No virtual meeting capability with outdated presentation materials unsuitable for screen sharing - » After:

Professional virtual meeting setup with branded backgrounds, high-quality presentations, and interactive engagement tools

Content Creative Strategy

- » Market Analysis:

Professional data visualization with institutional-quality research presentation - » Educational Content:

Interactive virtual presentations with engagement features maintaining institutional attention - » Thought Leadership:

LinkedIn-optimized content with professional design reflecting fund expertise - » Investor Relations:

Systematic communication materials with consistent branding and clear value propositions

Performance Impact

- » Virtual Excellence:

89% meeting completion rates exceeding industry virtual meeting benchmarks by 35% - » Content Authority:

8,500+ LinkedIn impressions establishing thought leadership during crisis period - » Relationship Quality:

Investor feedback indicating virtual meetings exceeded expectations and previous in-person experience quality

AD Creatives

◦ 09 // Conclusion

Key Success Factors:

Virtual Excellence -

Invested in high-quality virtual meeting infrastructure creating better investor experience than basic video calls

Authority Developmen

Established thought leadership through consistent, high-value market analysis during investor uncertainty period

Process Implementation

Created repeatable virtual relationship building processes enabling scale and consistency

Expansion Strategy

Leveraged virtual access to reach previously inaccessible investor markets and opportunities

Investor-Centric Design

Prioritized investor experience and preferences over internal operational convenience in all virtual engagement design

Crisis-to-Opportunity

Transformed operational disruption into competitive advantage through superior virtual relationship capabilities

Strategic Impact: Fund established virtual investor engagement leadership while competitors struggled with basic crisis response, creating sustainable competitive advantages and expanded market access.

Strategic Impact: Fund established virtual investor engagement leadership while competitors struggled with basic crisis response, creating sustainable competitive advantages and expanded market access.